The Balance Small Business. In addition to motor vehicle expenses such as insurance repairs fuel etc you may wish to claim CCA on the vehicle itself.

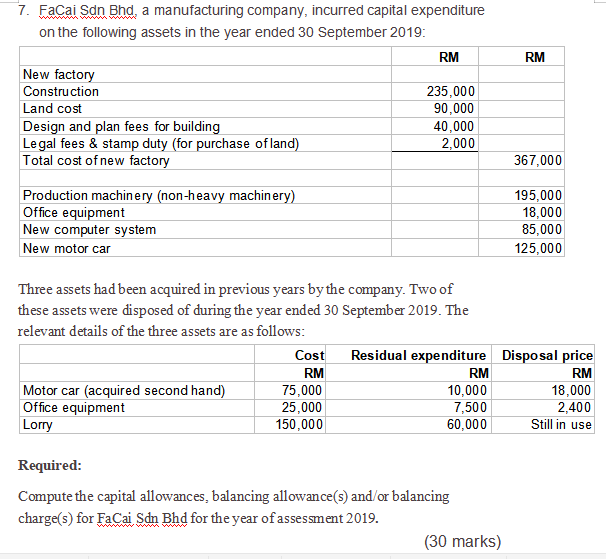

Rm 7 Facai Sdn Bhd A Manufacturing Company Chegg Com

Not payments by a trustee and.

. Basic Accessories and registration fees which is required by the road transport department RTD. Motor vehicles and some passenger vehicles are in Class 10 with a CCA rate of 30 unless your passenger vehicle was bought in the current tax year and costs more than 30000 in which case it falls into the special. As used in this article.

Motor vehicle for Capital Allowance is classified into 2 categories. A load of less than one tonne and fewer than nine passengers. Apart from the own-damage cover the auto insurance policy also provides coverage for third-party liabilities.

Q-plated and RU-plated cars. 1 Fleet means fifty or more marked private passenger motor vehicles or property carrying vehicles with empty weight of not more than twenty-two thousand pounds and a gross vehicle weight of not more than twenty-six thousand pounds owned or long-term leased by a corporation or other legal entity and. Capital Cost Allowance CCA is a set of rates stating the amount you can claim each year on a depreciable property used for business activities.

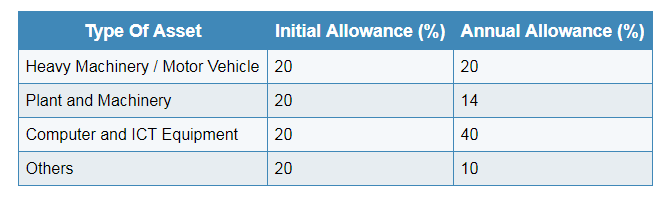

Most vehicles have emission levels over 130gkm in which case 8 of the purchase price can be deducted from your. A car is a motor vehicle that is. Capital allowances cannot be claimed on the costs of private cars eg.

In short the higher the emissions the less tax relief you can claim. When you look at Area ASchedule 8 you will see a table with eight different columns and a separate chart for Motor vehicle CCA. Capital Allowance Claim for Motor Vehicles.

Passenger private vehicle. Can affect how you calculate your. Kindly use Chrome Mozilla Firefox or Microsoft Edge for this site.

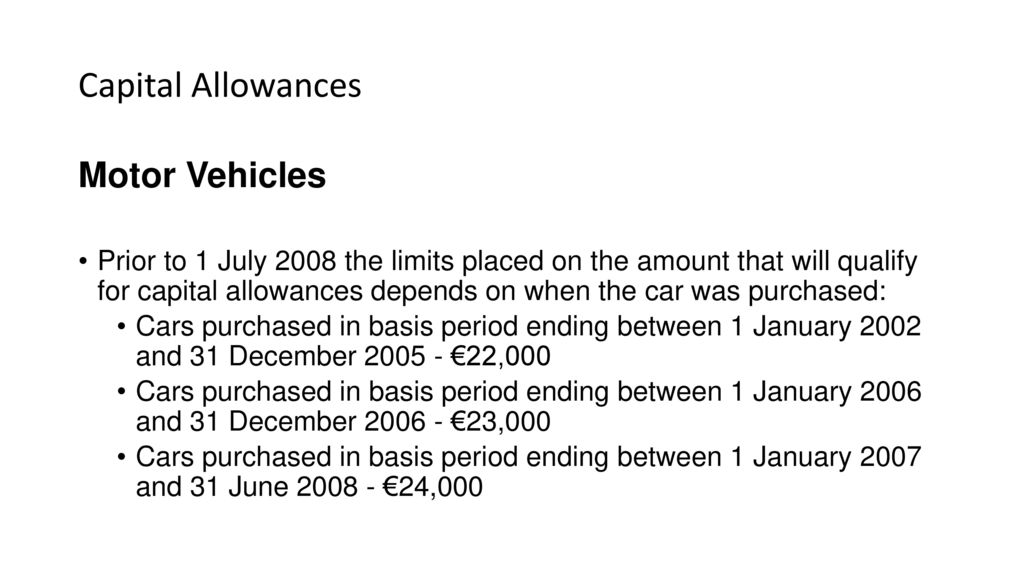

Motor Vehicle insurance is the most important document for all vehicle ownersdrivers. A Federal guaranteed trade-in allowance that is paid to a dealer will be treated in the same way as any other trade-in allowance provided the requirements contained in the Federal legislation are met. Qualifying new motor vehicles between July 1 2009 and November 1 2009.

Many four-wheel drives and some. If the motor vehicle qualifies for capital allowances the expenditure incurred on obtaining the COE may be included when claiming capital allowances on the. 2004 but before 2005 and you made an election.

To calculate CCA list all the. Two wheeler insuranceBike Insurance refers to an insurance policy taken to cover against any damages that may occur to your motorcycle scooter due to an accident theft or natural disaster. Eligible for capital allowance.

Information on motor vehicle expenses you can deduct as a salaried employee if you meet certain conditions. Line 9936 - Capital cost allowance CCA You might acquire a depreciable property such as a building furniture a motor vehicle or equipment to use in your business or professional activitiesYou cannot deduct the cost of the property when you calculate your net business or professional income for the year. Bike insurance is an ideal solution to.

Line 22900 was line 229 before tax year 2019. S-plated cars and business cars eg. However since these properties wear out or become.

Nevertheless starting from year of assessment 2001 the limitation amount for qualifying plant expenditure for motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers which is. This excludes any payments that are from a parents capital ownership of an investment activity or business that are. Eligible interest you paid on a loan used to buy the motor vehicle.

Its main objective is to give complete protection against physical damage or loss sustained by the insured vehicle from natural and man-made calamities. A motor vehicle is either a car or an other vehicle. Salary exchanged for private use of an employer-provided motor vehicle.

Two doors plus a swing-out rear door Three wheel motor Tricycle with cabin for carrying passengers is 8703 Duty is calculated according to cubic capacity cc Three wheel motor with bucket or container for cargo is 8704 Three wheel motor for the aged 8703. 2 wheeler insurance provides protection against third party liabilities arising from injuries to one or more individuals. Two fold-away bench seats stored on lateral penal in the rear section of the vehicle 4.

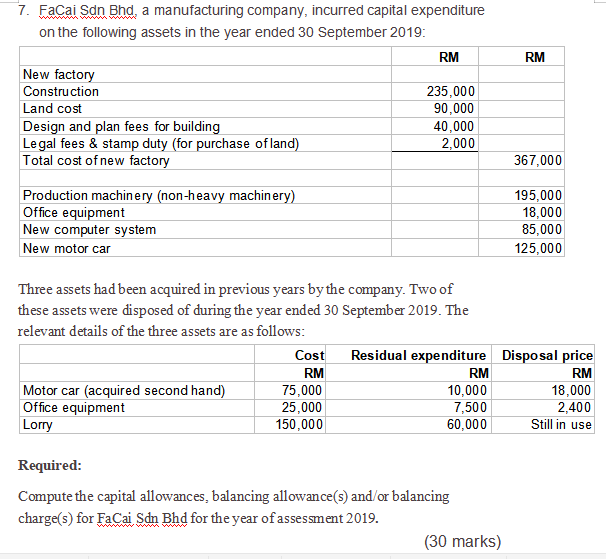

The type of motor vehicle you drive. There are strict rules regarding how much can be claimed and the amount of available capital allowance will largely depend on the vehicles CO2 emissions. Learn how to calculate capital cost allowance CCA for your Canadian business income and to fill out your tax return with this guide to the CCA schedule.

Any vehicle not classed as a motor vehicle The Canada Revenue Agency provides a chart of vehicle definitions for vehicles bought or leased after June 17 1987 and used to earn business income. Utes are classed as cars. Motor vehicles including some passenger vehicles can be included in this class.

For a student to get the Student Allowance their parents combined income must be less than. Commercial vehicle van lorry and bus What is eligible for capital allowance. Class 101 30 If you own a second vehicle that was purchased.

Capital allowance is only applicable to business activity and not for individual. Note that goods and services tax GST and provincial sales tax PST or harmonized sales tax HST should not be included when calculating the cost.

Fixed Asset Trade In Double Entry Bookkeeping

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Accounting Basics Purchase Of Assets Accountingcoach

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

2017 Use Of A Motor Vehicle Edited Youtube

Purchase Order Forms Check More At Https Nationalgriefawarenessday Com 20604 Purchase Order Forms

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Example Of Deferred Tax Assets Liabilities Transaction By Financial Accounting Issuu

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Volkswagen Car Spare Parts Browse Below Volkswagen Spare Parts By Models Volkswagen Volkswagen Car Volkswagen Beetle Convertible

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Capital Allowances By Associate Professor Dr Gholamreza Zandi Ppt Download

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Motor Vehicles Information Tax Department Tax Department North Carolina

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

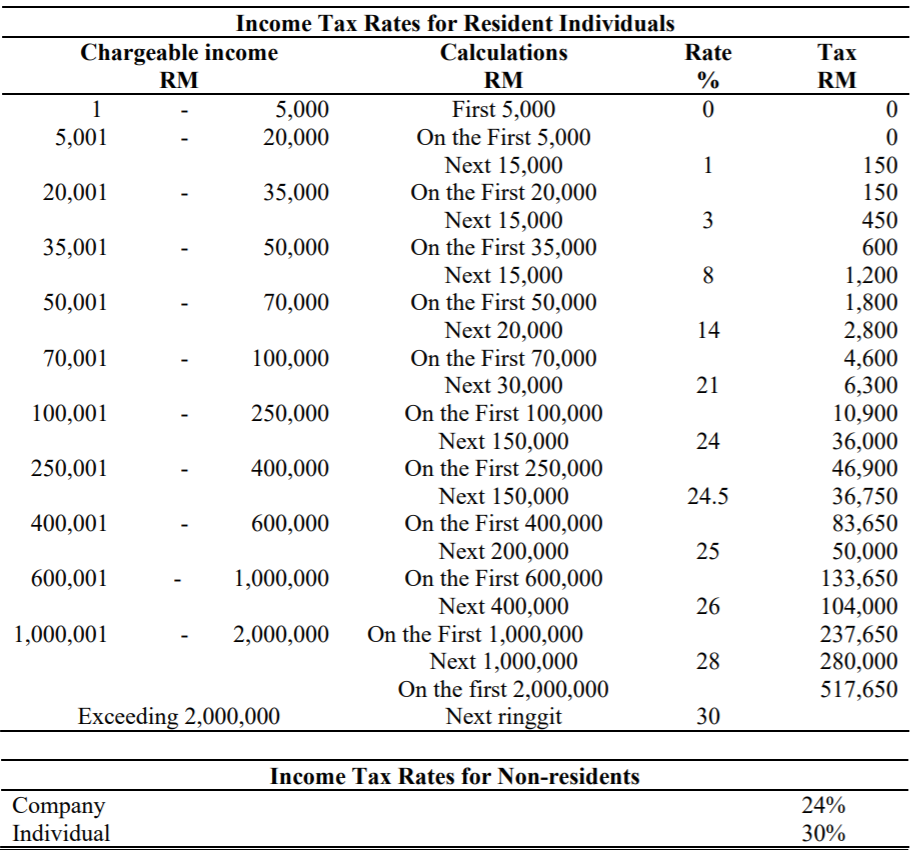

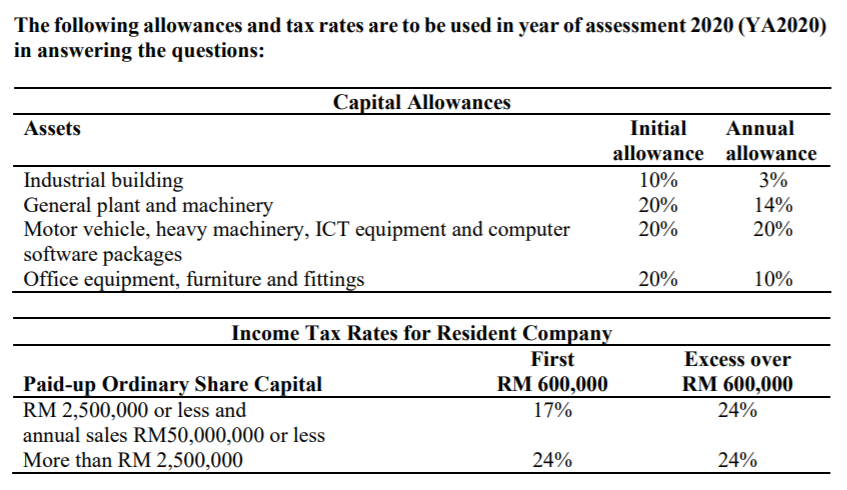

The Following Allowances And Tax Rates Are To Be Used Chegg Com

The Following Allowances And Tax Rates Are To Be Used Chegg Com